Most successful trading companies or groups endeavour to find suitable methods of rewarding and incentivizing key employees within the senior management team, with a view to retaining them on a longer term basis. These individuals can often play a vital role in a company’s ambitious growth plans, making it crucial to devise effective strategies.

While cash bonuses have traditionally been used, they pose certain challenges. They are costly to finance, lack tax efficiency, and fail to provide long-term incentives for employee loyalty or the enhancement of shareholder value. Therefore, it becomes necessary to consider alternative approaches that address these concerns.

The primary objectives of businesses who wish to incentivise key employees tend to be as follows:

- Exploring financial incentives: aims to explore various options for incentivizing employees, moving away from cash bonuses towards more sustainable and impactful alternatives.

- Tax-efficient approach: Selecting an incentivization method that benefits both the company and its employees from a tax perspective, ensuring efficiency in utilizing resources.

- Alleviating financial strain: By reducing the reliance on cash bonuses tied to past performance and metrics, businesses seek to ease the potential financial burden associated with such payouts.

- Driving shareholder value and loyalty: to foster loyalty among key employees while simultaneously developing and enhancing shareholder value.

Accordingly, this blog aims to delve into two viable employee incentive schemes: the Enterprise Management Incentives (EMI) scheme and a growth/hurdle share scheme.

#1 EMI scheme

An Enterprise Management Incentive (“EMI”) scheme is a HMRC approved employee share scheme that allows employers to grant share options to key employees in a tax efficient manner.

EMI schemes are an incentivisation tool for small and medium-sized companies in the UK to give their employees ownership stake in the business.

Restrictions are typically imposed to ensure EMI options only vest during a third-party sale or if the value of the company exceeds a particular ‘hurdle’; herby encouraging the employees to contribute to the growth of the company’s value, as they will have a stake in its increased capital and profitability.

There are certain conditions that must be met by a company to grant options under an EMI scheme and therefore it is essential to consult with a tax specialist to determine whether your company is eligible. However, most trading companies or groups with assets of £30m or less will be eligible.

Benefits of an EMI scheme

- EMI schemes and the valuation of the share options are approved by HMRC.

- The EMI scheme is not an ‘all employee’ scheme. The employer can invite selected, full-time employees to participate in the scheme.

- The employer can claim a corporation tax deduction equal to the difference between the market value of the shares at exercise and at the date of grant.

- Provided the options are exercised within ten years of their grant, the employees will only be subject to capital gains tax on the disposal of their shares equal to the difference between the market value of the shares at exercise and at the date of grant.

#2 Growth shares

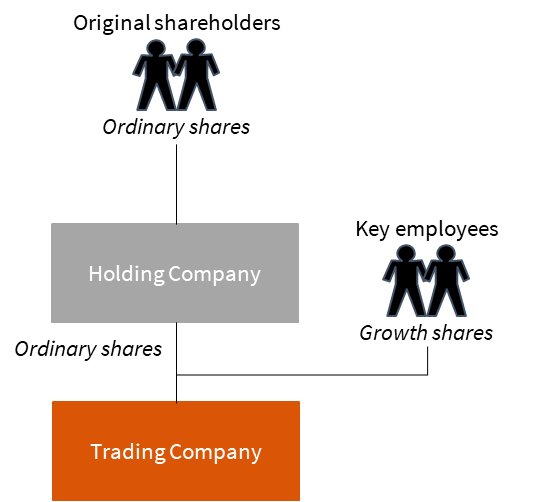

Where a company does not qualify for an EMI scheme, or where an EMI scheme would not be suitable, a growth or hurdle share scheme could be explored.

Growth shares provide an opportunity for the key employees to acquire genuine equity in the company in a way that enables them to share in the real growth in the value of the business that they will help to generate. A growth share delivers value to the key employees if the value of the company increases above a set ‘hurdle’.

There are no specific requirements or conditions to implement a growth share arrangement, however, the key employees will become shareholders of the company rather than just option holders.

Benefits of growth shares

- The returns that the key individuals will receive should be subject to capital gains tax only.

- Ideal incentivisation strategy for subsidiary companies without giving employees rights to the entire group.

- There is no limit on the value of shares that one employee can own.

- The growth shares can be structured to be non-voting and non-income bearing.

- Growth shares provide employees the opportunity to own “own” shares from the get go.